The Influence of Exonomics

Why Exonomic Pressures Predict Behaviour Better Than Age

In today’s rapidly shifting socio-technological landscape, the old binaries of “Boomer vs Millennial vs Gen Z” are steadily losing their explanatory punch. Instead, a more powerful lens is emerging. Economic and technological knowhow pressures. When financial constraints tighten, people’s behaviours, priorities, and tech adoption patterns change. Often in ways that cut across generational lines. In this article, I explore how the Tech Access & Fluency Era is shaped deeply by economic constraints and instabilities, resulting in what Amin Toufani terms Exonomics, meaning the examination of economic principles in light of exponential technological advancements.

I’ll show that economic pressure and technology literacy is now a stronger predictor of behaviour than age or cohort. While exploring the mechanisms through which that pressure influences technology habits, housing, lifestyle, regional variation, and cross-generational patterns.

2017 YouTube_Exonomics | Amin Toufani | Exponential Finance

The 8.2% Shift: Economic Factors Surpass Generational Labels

One of the most disruptive findings in recent behavioural and consumer research is that economic constraint is now quantitatively a better predictor of consumer behaviour than demographic categories like age or generation. In several analyst models, the “economic constraints driver” shows a coefficient of about 0.58, surpassing generational segmentation in explanatory power. For context: a coefficient of 0.58 indicates moderately strong influence in multivariate models of behaviour.

A coefficient is a numerical value that indicates the strength and direction of the relationship between variables in a statistical model. Coefficients can be positive or negative.

A positive coefficient means both variables move in the same direction, so when one increases, the other also increases.

A negative coefficient means they move in opposite directions, so when one increases, the other decreases.

The closer a coefficient is to 1 or –1, the stronger the relationship. Values near 0 indicate weak or no correlation. For example, a coefficient of 0.58 suggests a moderately strong positive influence, while –0.7 would represent a relatively strong negative one.

This insight is aligned with what many trend-tracking data sources have begun to show. For instance, the Financial Health Pulse research explores how financial stress and consumer resiliency affect choices over time, and highlights growing polarities in financial health across income segments.

In effect, what people can afford to do increasingly constrains what they choose to do. The “great equaliser” concept here is that when financial pressure deepens, it changes choices more than age. Younger or older, people constrained by cost must rethink their behaviour in housing, mobility, technology use, and consumption.

If we take generational labels off the table and instead segment users by “resource navigator,” “cost-aware adopter,” “value minimalist” and “upward striver,” we find more consistent behavioural patterns. This matters especially in the Tech Access & Fluency Era. It’s not how old you are, but how constrained your budget and tech fluency is, that shapes your digital life.

Housing, Technology, and Lifestyle

The Three Pillars of Economic Influence

Economic pressure does not exist in abstraction. It manifests in three core interlocking domains. Housing, technology, and lifestyle.

1. Housing as a Constraint Lever

Housing (rent, mortgage, utilities) is often the single largest fixed cost in most households. When housing costs rise disproportionately relative to income, it forces behavioural adjustments elsewhere, including in technology adoption, mobility, and consumption.

Trade-offs in location vs connectivity

Faced with high rents near urban cores, many people are pushed further into suburbs or peripheries, farther from transit and high-speed infrastructure. Others are restricted by geographical and/or political access, whether it’s a law against brands or platforms being used, or immigration challenges. These all add to the degrades of access to high-bandwidth networks or fibre, which in turn constrains what they can reliably do online (e.g., remote work, streaming, cloud gaming). This exacerbates digital divide challenges.“Shrinking to afford”

Some consumers reduce housing footprints, share space, or cut discretionary spending on other goods, including tech upgrades. The squeeze on available discretionary budget means fewer purchases of new devices, accessories, or subscriptions.Energy & utility burden

When energy costs rise, people become more frugal about overclocking, charging, or using high-power devices. Favouring energy-efficient models or delaying upgrades.

Hence, housing pressure indirectly shapes tech access and tech fluency, because it reallocates where (and whether) one can afford connectivity, compute, and upgrades.

2. Tech Adoption, Upgrades, and Literacy Under Constraint

In the Tech Access & Fluency Era, where digital skills and tools are increasingly core to participation in society, economic constraints significantly shape how people engage with tech.

Delayed or deferred upgrades

Many households postpone replacing phones, laptops, or IoT devices, stretching the lifecycle of older hardware beyond optimal performance (Planned obsolescence plays a role here, but we’ll cover that another day). That means slower performance, dropout on newer features, and weaker security. In university settings, for example, students will feel the “tech squeeze”. Paying more while affording less. For example UCAS stated, “Apple’s iPhone 14 Pro launched at £150 more than the previous model. Tech has become an essential component, and with neither wages nor student loans keeping pace, there lies the problem.”Selective spend and prioritisation

Under tight budgets, the tech purchases people make skew toward essentials (connectivity, mobile data, cheap entry devices) rather than premium or experimental gear (AR/VR, smart home, 8K TVs). This means that mass adoption of bleeding-edge tech slows, and firms must compete on price/performance and utility, not novelty.Fluency penalty

Because constraints limit opportunities to explore, upgrade, or tinker, users on tighter budgets often lag in digital fluency. Meaning they don’t discover or use advanced features or platforms, reinforcing a skills gap. This reinforces the digital divide (in its motivational, skills, and usage dimensions) rather than only the access dimension.Subscription fatigue and micro-pricing

As continuous software models proliferate, consumers with constrained finances are more likely to unsubscribe, skip license renewals, or opt for “lite” or freemium versions. That may reduce usage of cloud tools, premium apps, or advanced AI features.

At the intersection of adoption and fluency, tech brands will increasingly compete on modular access, lightweight versions, pay-as-you-go models, and “digital minimalism” options that deliver core utility without excess cost overhead.

3. Lifestyle: Consumption, Mobility, and Behaviour Adjustments

When budgets compress, lifestyle choices adapt, and these adaptations flow into tech behaviour and expectations.

“Platform diet”

People consolidate entertainment, shopping, communications on fewer platforms to reduce subscription costs or avoid fragmentation (e.g. fewer streaming services, fewer specialised apps). This raises the value of “all-in-one” ecosystems.Secondhand and refurb economy

Buying refurbished or used devices becomes far more common. Brands like Back Market or certified refurbished lines (e.g. Apple’s refurbished store, CEX, etc.) become critical access points in this era.Shared economy tools

Although recently there has been a push from many businesses to bring back the five day in the office week, shared co-working (rather than home offices), device rentals, communal Wi-Fi hubs, shared mobility (bikes, scooters) will continue to be more attractive as household budgets are stretched. Tech vendors may need to shift from “owning a device” to “accessing a shareable subscription.”Experience and convenience over ownership

As ownership costs (maintenance, replacing parts, insurance) become less desirable, consumers prefer experiences (cloud gaming, streaming) over buying hardware or media, but with some caveats around data usage and cost.Psychological frugality

Financial pressure influences mindset. More conservative attitudes toward risk, experimentation, or “premium luxuries.” People will avoid trialing new gadgets unless demonstrably necessary or affordable.

Thus, lifestyle shifts induced by economic constraints connect directly with how people adopt and sustain technology usage. Reinforcing the importance of cost efficiency, modular access, and simplified value propositions.

Regional Economic Patterns

Economic constraints operate differently across geographies. The patterns and magnitudes vary greatly, which in turn influences how tech access and fluency evolve regionally.

Economic Influence Coefficiencies

In recent regional segmentation studies, Latin America stands out as having an economic constraints coefficient of 0.71. Meaning economic pressure is a very strong predictor of behaviour there. By comparison, Asia Pacific often shows coefficients nearer 0.52 in the same modelling frameworks, indicating weaker but still meaningful influence. These numbers highlight that in Latin America, resource limitations more strongly funnel consumer decisions.

What drives that? Latin America faces deeper inequality, volatile inflation, exchange rate instability, and fragile social safety nets. Meaning more households live closer to the margin of financial stress (Deloitte United Kingdom). In moments of macro stress (currency devaluation, inflation surges), many consumers regress into behaviour strictly constrained by cost.

In Asia Pacific, by contrast, while economic constraints matter, stronger infrastructure, broader middle class, and more public investment cushion some of the pressure, though not uniformly (rural vs urban, developed vs emerging markets show sharp divides). The lower coefficient (≈ 0.52) signals that generational or cultural factors still retain some weight in explaining tech behaviour there.

This regional variation is important for firms building global strategies. For example:

A “premium subscription bundle” promotion may gain traction in parts of Asia Pacific, but struggle in Latin America, where lower-cost modular access or flexible pricing will outperform.

In Latin America, refurb and secondhand markets may surge. In Asia, device upgrade cycles may remain more regular (particularly in middle-income markets).

Partnerships with microfinance or device-leasing organisations may be more impactful in Latin America, where many buyers lack credit access.

Education and digital fluency initiatives may need to be deeper and more subsidised in Latin American contexts, as constraints hamper self-driven uptake.

Finally, even within regions, subregions differ. For example, urban vs rural, frontier vs mature markets, and connectivity infrastructure all mediate how much economic pressure translates into behaviour.

Hidden Constraints Amid Apparent Affluence

While high-income regions might seem immune to economic constraint, many pockets of pressure remain (student debt, housing cost, inflation, rising interest rates). The notion that these regions are “safe zones” from constraint is misleading.

In the US, for example, the Financial Health Network shows deep divides in financial well-being by income, race, and debt load. Meaning that many households are just as constrained as consumers in “emerging” markets.

Across Europe, housing costs, inflation in energy and food, and wage stagnation are pushing more households into trade-offs. Brands operating in Western Europe must be attuned to “cost-conscious premium seekers” who still value quality but demand justifiable price.

Thus, in mature economies, constraint does not vanish. It simply hides behind affluence norms. The tech access and fluency era in those markets becomes about value compression, extracting more utility at lower cost, rather than pure disruption.

The Cross-Generational Cost-Conscious Consumer

When economic pressure is the dominant lever, generational labels fade in importance. The behaviours that used to be associated with particular age groups now cascade across all ages, as people adapt to tighter finances.

1. Young Professionals, Mid-Life, and Retirees All Feeling the Squeeze

A 30-something professional saddled with inflated housing costs and childcare may make the same tech trade-offs as a 60-something retiree watching pension yields shrink. Both may skip hardware upgrades, consolidate subscriptions, or prefer budget-friendly services.

Retirees with fixed incomes are particularly vulnerable to inflation and may delay adopting new tech due to cost, slowing their fluency. That reduces demand for “elderly tech” unless it’s extremely cost-sensitive.

Students and entry-level workers are often acutely price-sensitive, but as financial stress deepens, their tech choices resemble those of older cohorts, consolidating, extending lifecycles, or opting for refurbished.

2. Hybrid Behaviour Patterns: Some Luxury, Some Frugality

Many consumers blend frugal core behaviour with selective splurges. Budgeting tightly on basics, but still willing to invest in a “necessary luxury” (e.g. a premium phone or a high-quality pair of headphones). These hybrid patterns cut across ages.

Some may subscribe to only one streaming service but pay extra for high-end headphones or noise cancellation.

Others may skip a brand new gaming console but invest in a mid-tier GPU upgrade for an old PC.

These hybrid behaviours defy simple generational assumptions (e.g., “Gen Z always ante up for new tech”), cost-consciousness reshapes the logic.

3. Tech Fluency as an Asset Buffer

In times of constraint, tech fluency becomes a buffer. Those with higher digital skills extract more value from existing devices (e.g. using shortcuts, open-source tools, automation). So paradoxically, the same age group (e.g. late-career professionals) may diverge sharply. Some who invest in digital fluency will thrive using lean tools, while others who lag will fall behind.

Thus, brands and educators in the tech access and fluency era need to think in terms of fluency pathways (teachable, modular, accessible) rather than elegant but costly flagship experiences.

The Tech Access & Fluency Era: What It Means Over the Next 5 Years

Given this framing of economic constraint as the meta-driver, how does the emerging Tech Access & Fluency Era unfold over the next half-decade?

1. Device Ecosystems Must Lean Modular, Tiered, and Transparent

As consumers become more selective, device ecosystems that can scale down and up gracefully will win.

Modular phones or scalable compute platforms

Projects like Fairphone (modular repairable phones) or Nvidia MGX (modular server designs) will attract renewed interest among cost-aware users.Entry-tier flagship options

Brands will emphasise “lite” or “a” series (as Apple does with iPhone SE) to capture those who need performance but not extravagance.Transparent pricing and repairability

Consumers will favour clarity (no hidden fees) and repair-friendly design, reducing “upgrade tax.”Subscription hardware models

Renting, leasing, and “device-as-a-service” will become more common, especially in markets with constrained credit.

2. Fluency APIs, Education, and Incentives

To pull more consumers into higher-value usage, brands and platforms will focus on fluency enablement.

Micro-learning in-app, tooltips, gamified tutorials.

Partnership with educational institutions or internet cafes for “fluency credits.”

Incentives (e.g. discounts) for proficient use. Unlock advanced features only if users complete short fluency modules.

Community support, shared user ecosystems, peer help.

Over time, fluency may become a bargaining chip, “gain X fluency points, unlock premium features.”

3. Emergence of “Connectivity as a Utility” Models

Just as water and electricity are utilities, broadband connectivity is increasingly treated as baseline entitlement in developed markets. In constrained markets, subsidised shared hubs or “digital inclusion zones” (e.g. in co-working spaces, public libraries, co-op housing) will expand. This baseline connectivity lowers barriers for device adoption and fluency progression.

4. Regional Differentiation Deepens

Global brands will need regionally tailored models, not merely translating pricing.

Across Latin America, refurb, leasing, micro-finance partnerships, and ultra-entry devices will be key.

Across Africa, “device drop zones” and community hubs (shared computing and training) will gain prominence.

Across Asia Pacific, mid-tier upgrade cycles will remain, but high-end brands must justify value, not hype.

5. The Premium-Friction Frontier

Even premium offerings won’t escape the constraint logic. Luxury tech will need to justify itself with clear ROI or emotional value. Novelty alone will no longer command price premiums. Brands that succeed will blend elegance with utility, repairability, and transparency.

6. Behavioural Resilience Oscillation

Periods of macro stress (recessions, inflation surges, currency shocks) will amplify constraints, but in phases of relief, consumers may revert to some discretionary spending. Tech firms must design for flexible elasticity. Features, price points, and modular upgrades that can flex with macro cycles.

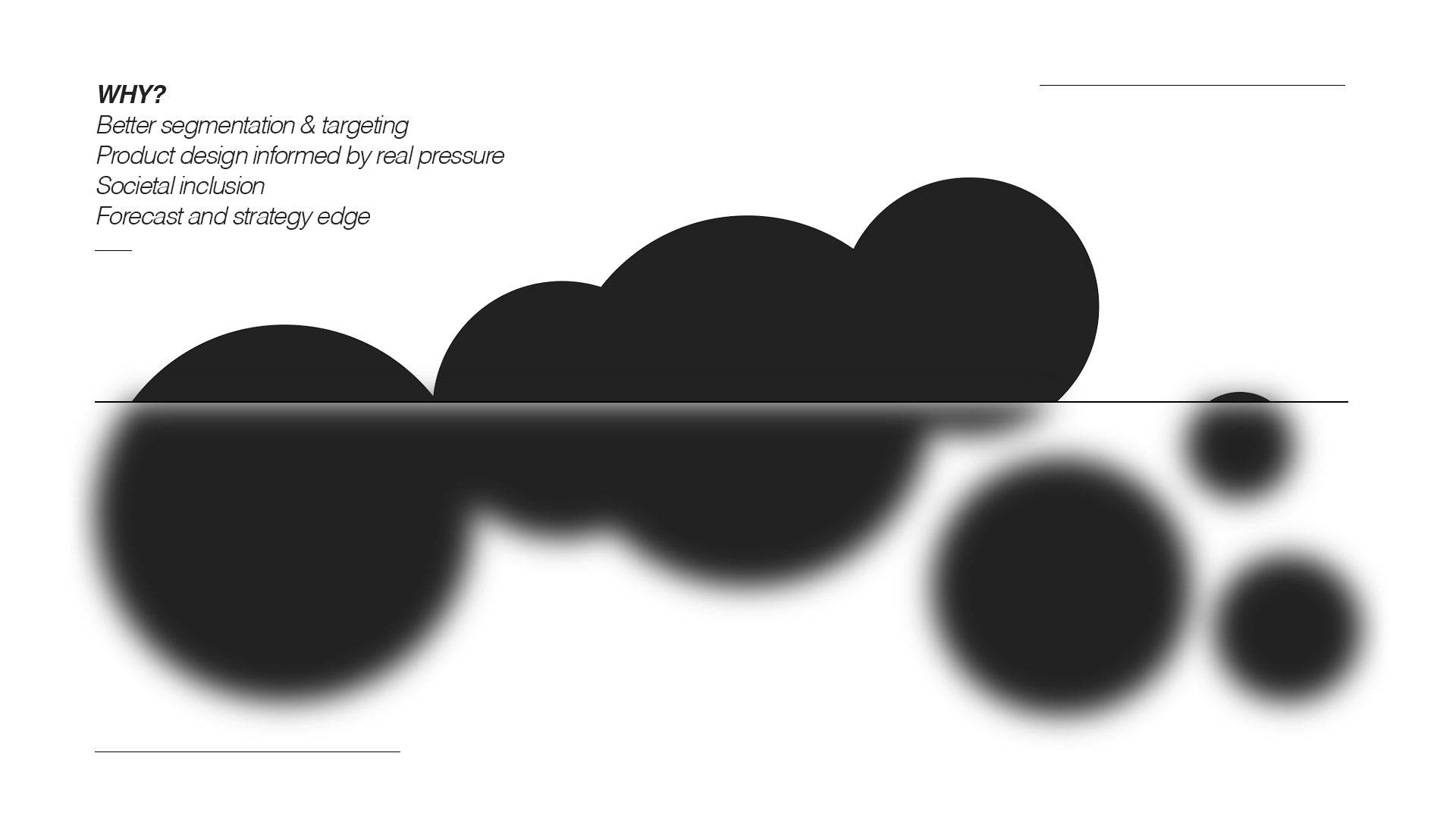

Why This Matters Today

Better segmentation & targeting

Marketers and product teams need to shift from generational stereotypes to constraint-based segmentation. That means embedding affordability, upgrade rhythm, fluency potential into personas or profiles.Product design informed by real pressure

Instead of adding features, think about what users can sustain, power usage, bandwidth limits, upgrade paths, repairability, modular interfaces.Societal inclusion

As work, education, finance, and social interaction go ever more digital, exclusion due to economic constraint becomes a social and civic issue. Better access and fluency models contribute to closing inequality.Forecast and strategy edge

Firms oriented to this era can anticipate which markets adopt more slowly, which types of offerings will play, and how to pivot in periods of macro stress.

In the unfolding Tech Access & Fluency Era, economic pressure becomes the principal navigator of behaviour. It shapes who upgrades, who dives deeper into fluency, who delays, and who drops off. Age and demographic lenses still have utility, but they are becoming secondary. Those who adapt by designing for affordability, modular access, fluency scaffolding, and regionally nuanced strategies will win in this new era.

In this context, Design and Innovation Strategy plays a crucial role in translating these economic and behavioural insights into actionable direction. By combining ethnographic research, quantitative modelling, and cultural foresight, strategists can identify the hidden motivators, constraints, and trade-offs that shape real human behaviour, far beyond surface demographics. This approach allows teams to segment audiences not by age or income alone, but by mindset, fluency, and contextual limitation. Through this lens, design becomes a tool for empathy and precision. Revealing how people truly navigate constraint, and how brands, systems, and services can meet them there.